Do you find it difficult to comprehend your organisation’s expenses? This step-by-step guide will display how to examine your commercial enterprise charges effectively. You will gain precious insights into your spending patterns by gathering economic data, classifying and organising costs, and identifying cost influencers.

Equipped with this information, one can assess the return on investment, execute strategies to reduce expenses and optimise financial efficiency. Prepare to gain command over your expenditures and improve the profitability of your community.

Gathering Financial Data

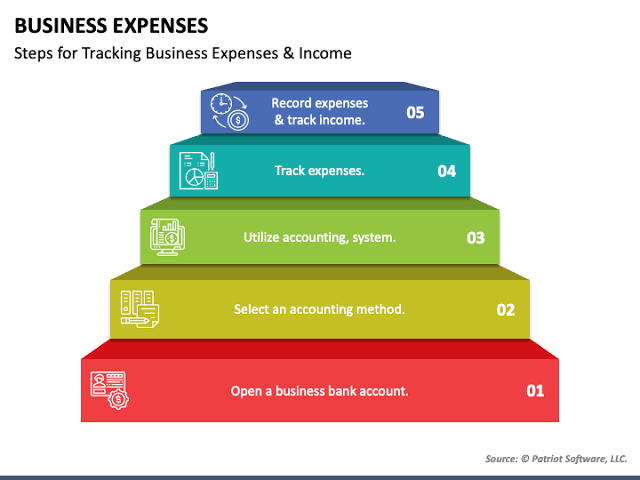

You must initially compile all of your financial information. This consists of invoices, receipts, bank statements, credit card statements, and other documentation detailing your business expenditures. Gathering data spanning a minimum of three months is imperative to comprehensively comprehend one’s expenditure patterns. After gathering all the required documents, systematically arrange them.

One may establish containers to correspond with various categories, including utilities, office supplies, marketing expenses, and so forth. Subsequently, this will facilitate the process of analysing and monitoring your expenditures. Furthermore, it is advisable to utilise accounting software or spreadsheets to input and classify your expenses electronically.

Categorising and Organising Expenses

Utilise labels that are consistent and unambiguous when classifying and organising expenditures. This will facilitate the identification and tracking of various categories of business expenses, thereby reducing the effort required to analyse them in the future. Commence the process by establishing overarching categories encompassing every facet of your enterprise, including personnel, marketing, and administrative costs.

Reduce the expenditures within each category to more precise subcategories. For instance, subcategories for administrative expenses might include rent, utilities, and office supplies. To prevent confusion, use the same identifiers consistently throughout all of your financial records. Furthermore, contemplate implementing software or tools that facilitate the organisation and classification of your expenditures, thereby enhancing the efficiency and precision of the process.

Identifying Cost Drivers

The process of identifying cost drivers enables one to gain insight into the variables that exert the greatest influence on expenditures. Identifying these variables allows one to make well-informed decisions to maximise the business’s expenditures. Beginning with an examination of your expenditures, search for patterns. Are there specific categories characterised by consistently high prices? These might represent cost concerns.

Additionally, evaluating one’s internal operations is crucial. Are there any particular procedures or activities that incur significant expenses? These may also contribute to increased costs. After identifying the primary influencers, one can concentrate on devising strategies to decrease expenses in those domains, ultimately enhancing financial performance.

Implementing Cost-Cutting Strategies

By implementing techniques to reduce charges, businesses can enhance their economic performance and allocate resources extra efficiently. Organisations can improve their profitability and overall monetary performance by figuring out capacity value-reducing channels. An approach to lowering prices is to barter with providers to steady extra favourable terms, consisting of locating alternative providers who provide decreased-priced goods without sacrificing quality.

Efficiency-enhancing measures may include automating precise responsibilities, reducing dependence on paper-based processes, and optimising workflow. Moreover, to avoid paying penalties for late bills, a robust bank reconciliation toolshould be used to ensure that every payment is made on time.

Monitoring and Adjusting Expenses

After the successful implementation of cost-cutting strategies, the subsequent step entails the monitoring and adjustment of expenses. This pivotal stage guarantees that one remains focused and consistently makes well-informed decisions regarding business expenditures. Through consistent surveillance of one’s expenditures, potential areas of overspending or unnecessary spending can be identified.

This enables prompt decision-making, including renegotiating contracts, investigating more economical alternatives, or curtail expenditures. Adjusting your expenditures through this monitoring procedure can maximise your savings and optimise your budget. Maintaining the awareness that expense monitoring and adjustment should be a continuous endeavour is crucial for securing your enterprise’s enduring financial viability and expansion.

Maximising Financial Efficiency

To maximise your financial resources, prioritise financial efficacy through expenditure optimisation and identifying money-saving opportunities. Beginning with assessing your expenditures, identify areas where you can reduce costs. Consider other vendors or attempt to negotiate more favourable terms with your current ones. Automating specific duties or instituting energy-efficient practices are two cost-saving measures to consider.

Streamline your operations by removing redundant efforts and excessive procedures. Additionally, one can optimise financial efficiency by employing technological advancements and software applications that facilitate enhanced expense tracking and management. In addition, assess your budget and financial objectives frequently to ensure you are on track and to make any necessary adjustments.

Conclusion

Through adherence to this guide, one can assess the expenditures of their organisation and render judicious judgments to enhance fiscal efficiency. Gaining valuable expertise in the prices of an enterprise may be done by accumulating and establishing monetary facts, identifying price drivers, and investigating fee patterns.

Budget optimisation can be achieved through the implementation of cost-cutting strategies and the evaluation of return on investment. Your business can ultimately ensure long-term financial success through consistent expense monitoring and adjustment. Therefore, immediately begin implementing these strategies and observe your business grow.