As a company grows, it can be increasingly complicated to manage payroll month by month. In these cases, we usually resort to Human Resources software for SMEs and large companies to help us with the documentation of the salary of the company’s staff.

Therefore, in this article, we will explain what quality payroll & benefits are, 3 application methods, and their respective advantages. Keep reading!

Payroll Management: What Is It?

Payroll management is the process of any company that is responsible for the administration of the calculation and payment of employees’ payroll. In the same way, it is also in charge of your registrations, cancellations, or payments to the Treasury.

This is a complex and delicate task, which requires legal, tax, and labor knowledge, as well as appropriate software to facilitate the process.

To carry it out, a payroll management model is followed, as it is usually a tedious task that requires total precision. Furthermore, it consists of a legal procedure. The payroll is a document that reflects in writing the salary of a worker.

What Are The Mandatory Requirements For Payroll Generation?

The generation of workers’ payrolls must meet certain mandatory requirements. This process adheres to specific margins that have legal validity, so we must keep them in mind. Below, we explain what sections the generation of obligatory payrolls must include:

- Contract types

- The seniority of the employee.

- Job category.

- Extra hours.

- Deductions.

Once these obligations are contemplated, the payroll preparation process is also unchangeable. In this sense, month by month, the company will do the following:

- Prepare and deliver to each worker a monthly salary receipt or payroll. This must contain the identifying data of the worker and the company. In addition, it must have attached the settlement period, the base salary, salary supplements, deductions for Social Security contributions and personal income tax withholdings, and the net amount to be received.

- Enter Social Security contributions through the Direct Settlement System (SILTRA), which allows you to communicate the real data of each worker and calculate the corresponding contributions.

- Enter personal income tax withholdings, which must be submitted to the Tax Agency within the established deadlines.

- Comply with the formal obligations that arise from the registration, cancellation or modification of workers’ data in the General Social Security Regime.

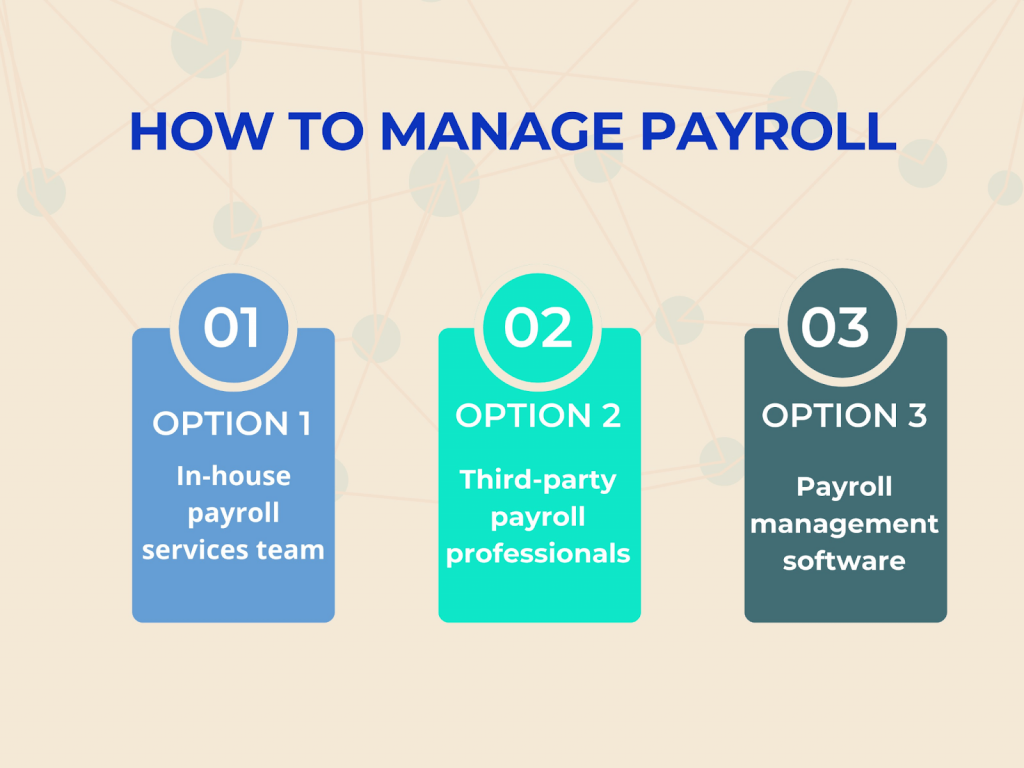

The Three Main Payroll Management Methods

Now, because this is a somewhat cumbersome procedure for companies, many usually apply one of these three methods to execute their payroll management. Try to use the one that best suits the current situation of your company.

Internal Payroll Management

Internal payroll management means that a team within the company itself will be solely responsible for managing employee payroll. This method implies that the company has full control over the payroll process and data, as well as the possibility of customizing it according to its needs. Before doing so, certain questions must be considered:

- High labor cost, since it requires training internal payroll personnel.

- Human calculation errors can lead to fines, sanctions, or claims.

- Constant updating, which implies investment in software and expensive training.

Payroll Outsourcing

As the name suggests, it is done by subcontracting an external company to handle payroll processing. This method involves the company delegating payroll tasks to a third-party provider. Among its advantages, we must consider that it implies great cost savings, is more efficient and precise, and guarantees greater data security.

Online Payroll Management (SaaS)

Online payroll management (SaaS) is a type of program that allows the user to interact with data when browsing the Internet. It can be said that online payroll management is a synthesis between internal management and a company specialized in this activity.

This method involves the company accessing an online platform that allows it to manage the payroll process with ease and flexibility.

It is among the most used and recommended today. It means a great saving of time for companies, in addition to being easily adaptable since the software updates automatically. On the other hand, it is quite secure, since the company can keep your data safe through passwords, permissions, and protocols.

With this in mind, it is up to the employer to consider which payroll management method is most convenient for them.